The hyperscalers need nuclear power. 10 GW of deals in 18 months. More capacity than the US has built in 30 years. But nuclear has a supply chain. Uranium gets mined, converted to gas, enriched, fabricated into fuel. Each stage has its own facilities, capacities, bottlenecks. The deals get covered. The fuel cycle doesn't.

Demand Shock

Hyperscaler nuclear power demand is exploding. In 2025 the US data center load is around 61.8 GW 1. This is up 22% from 2024, which had a load of ~50.5 GW. Projections predict demand to go up to ~75.8 GW in 2026.

A single gigawatt is roughly the same amount of power needed to power 750,000 US homes, or a mid-sized American city 2. A single large nuclear reactor can produce a single gigawatt. To produce the same amount of energy with natural gas would require about 3 natural gas plants.

The Scale of the Bet

The US operates 94 nuclear reactors with 97 GW of total capacity, the largest fleet in the world 3. Within 18 months hyperscalers have made 10 GW of nuclear deals which is more nuclear capacity contracted than the US has built in 30 years 4. These deals have been made by four companies. That's 10% of the entire existing US nuclear fleet contracted by four companies.

The 2025 hyperscaler capital expenditure: ~$350-400 billion 5. Of that, ~75% is AI infrastructure: servers, chips, data centers 6. The capital expenditure is projected to total $1.15 trillion between 2025-2027 7. Three of these deals depend on fuel that doesn't exist at commercial scale.

| Company | Partner | Type | Capacity | Term | Online |

|---|---|---|---|---|---|

| Microsoft | Constellation | Restart | 835 MW | 20 yr | 2027 |

| Amazon | Talen Energy | Existing | 1,920 MW | 17 yr | 2026-2032 |

| Kairos Power | SMR (HALEU) | 500 MW | — | 2030-2035 | |

| Meta | Constellation | Existing | 1,121 MW | 20 yr | 2027 |

| Meta | Vistra | Existing + Uprates | 2,609 MW | 20 yr | 2026-2034 |

| Meta | Oklo | SMR (HALEU) | 1,200 MW | — | 2030 |

| Meta | TerraPower | SMR (HALEU) | 2,800 MW | — | 2032-2035 |

~11GW of nuclear power demand

Why Nuclear

Nuclear works for data centers because it runs constantly. According to the U.S. Energy Information Administration capacity factor data for 2024 8, nuclear has the highest reliability by a large margin when compared to other energy sources.

RELIABILITY BY ENERGY SOURCE

Nuclear █████████████████████████████████████████ 92%

Natural Gas █████████████████████████ 60%

Coal ███████████████ 42%

Wind ██████████ 33%

Solar █████ 23%

Capacity factor measures actual output versus theoretical maximum over a year. A 1-gigawatt nuclear plant delivers 920 megawatts on average and is limited mainly by scheduled refueling and maintenance. A 1-gigawatt solar farm delivers 230 megawatts on average, limited by the fact that the sun doesn't shine at night or through clouds. For a data center that needs power every hour of every day, this isn't an environmental preference it's arithmetic.

Fuel Cycle 101

Nuclear power has an elaborate supply chain with many components. Uranium doesn't arrive enriched. It goes through four stages before it becomes fuel.

Mining & Milling: Ore → Yellowcake

The process starts with mining uranium ore which is about 0.1-20% uranium content depending on grade. Then you mill down the ore into a powder and purify it. This is commonly done at or near the mine site. You're extracting uranium from rock.

Once mined you crush the ore into fine particles. Then you dissolve the powder in sulfuric acid or alkaline carbonate solution and filter out the undissolved byproducts. Then do another purification step involving ion exchange on the solvent. Then finally you precipitate the solution by adding chemicals to drop uranium out of solution as a solid resulting in dry yields of yellowcake powder (U₃O₈).

| Company | Country | Share |

|---|---|---|

| Kazatomprom | Kazakhstan | 23% |

| Cameco | Canada | 15% |

| Orano | Niger/Kazakhstan | 8% |

| Uranium One | Russia/Kazakhstan | 5% |

| CGN | China/Namibia | 5% |

| Navoi Mining | Uzbekistan | 5% |

| BHP | Australia | 4% |

| Energy Fuels | USA | <1% |

Top 3 countries: Kazakhstan 43%, Canada 7%, Namibia 7%* Supply adequate

The precipitate, a yellow coarse powder roughly 80% uranium by weight, is packed into drums as a standardized commodity for shipping. Yellowcake from Kazakhstan, Canada, and Namibia all goes into the same global supply chain. Gets shipped to conversion facilities (Port Hope, Tricastin, Metropolis) to become UF₆.

Conversion: Yellowcake → Uranium hexafluoride (UF₆)

Yellowcake is powder. You can't enrich powder. Conversion turns it into uranium hexafluoride (UF₆), a gas that can be spun in centrifuges. The process runs through multiple stages: dissolving yellowcake in nitric acid, purifying the solution, reacting it with hydrofluoric acid to produce "green salt" (UF₄), then fluorinating that at 500°C to get UF₆. The purity requirements are extreme. Enrichment centrifuges are precision equipment and contamination destroys them.

| Company | Facility | Capacity |

|---|---|---|

| Orano | France (Tricastin) | 15,000 tU |

| Cameco | Canada (Port Hope) | 12,500 tU |

| Rosatom | Russia | 12,500 tU |

| CNNC | China | 15,000 tU |

| ConverDyn | USA (Metropolis) | 7,000 tU |

Western capacity: 34,500 tU Near capacity

Every metric tonne of U₃O₈ (yellowcake) outputs about ~0.98-0.99 metric tonnes of UF₆. By compound mass it's different (U₃O₈ is 85% uranium, UF₆ is 67% uranium), but the industry measures in tU to keep it comparable.

Enrichment

Natural uranium is 0.7% U-235 (fissile) and 99.3% U-238 (not fissile). Reactors need higher U-235 concentration. The enrichment happens through a gas centrifuge process. The uranium hexafluoride is heated to gas, and fed into a cylindrical rotor. The rotor spins at 50,000-70,000 RPM which is a wall speed approaching Mach 2 (twice the speed of sound). The centrifugal force pushes heavier U-238 toward outer wall, lighter U-235 concentrates toward center. Countercurrent flow thermal gradient creates vertical circulation. Enriched gas is drawn from top-center, depleted gas from bottom-outside.

Separative Work Units (SWU)

SWUs are a measure of the effort required to separate U-235 from U-238 in a centrifuge. You can think of it as a standard measure of enrichment. Enrichment companies sell SWU as a service. You give them UF₆, they spin it, you get enriched UF₆ back. Current spot price is ~$190/SWU.

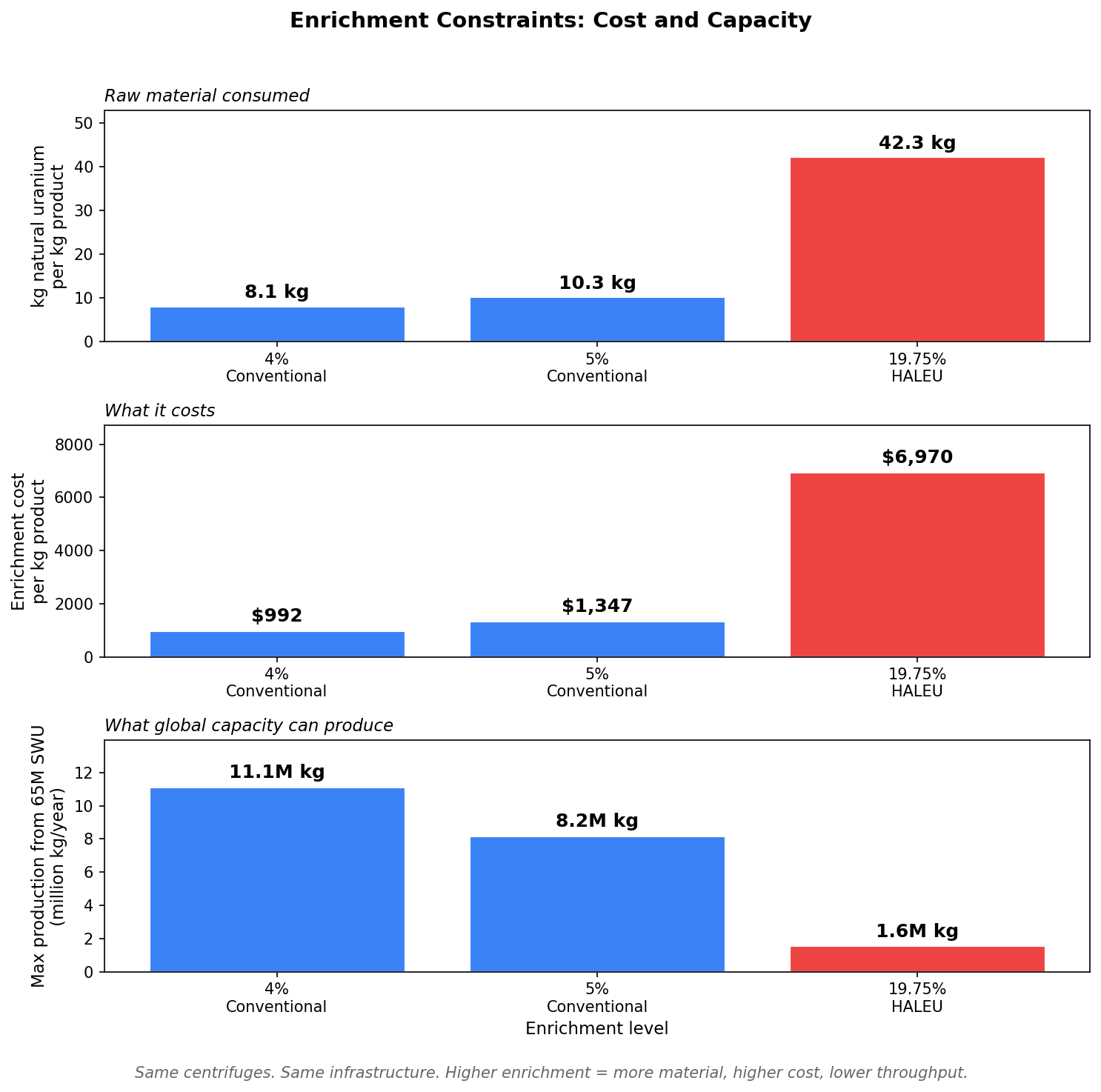

The kicker here is that not all nuclear reactors require the same amount of enrichment. Traditional nuclear reactors require low-enriched uranium (LEU) which usually refers to 3-5% U-235. Most modern reactors and all of the small modular reactors (SMRs) require a much higher enrichment called High-Assay Low-Enriched Uranium (HALEU) referring to around 19.75% U-235 concentration. To produce 1 kg of 4% LEU requires ~4-5 SWU. To produce 1 kg of 19.75% HALEU requires ~15-20 SWU. Same machines, more work.

Depleted uranium (mostly U-238) is the byproduct. Operators choose how much U-235 to leave behind, lower tails = more product extracted but more SWU required. There is an economic tradeoff based on uranium vs SWU prices. Modern centrifuges are carbon fiber rotors, magnetic bearings, operate for decades. Rosatom, Urenco, Orano, CNNC are the major operators. Centrus is the only US enricher, currently demo-scale for non-standard enrichment.

The output is enriched UF₆ in cylinders. 3-5% concentration for conventional reactors. 5-19.75% for HALEU (advanced reactors). Above 20% is weapons-grade (HEU) which is illegal for commercial use.

| Company | Country | Share |

|---|---|---|

| Rosatom (TENEX) | Russia | 46% |

| Urenco | UK/DE/NL/USA | 29% |

| CNNC | China | 12% |

| Orano | France | 10% |

| Centrus | USA (Piketon) | <1% |

US imports 25% of enrichment from Russia (ban 2028)* — Russia controls 46%

In enrichment you lose a lot of mass depending on the U-235 concentration required. More U-235 concentration correlates to needing more input.

| Reactor | Developer | Fuel Type | Enrichment |

|---|---|---|---|

| Natrium | TerraPower | Metallic | ~19.5% |

| KP-FHR (Hermes) | Kairos | TRISO pebbles | ~19.75% |

| Xe-100 | X-energy | TRISO pebbles | HALEU (5-20%) |

| Aurora | Oklo | Metallic | HALEU |

| VOYGR | NuScale | Conventional UO₂ | 4.95% |

SMRs need higher enrichment

HALEU requires 5x more natural uranium and 7x more enrichment work than conventional fuel. That 7x multiplier shows up twice: enrichment costs ~$7,000/kg versus ~$1,000/kg, and global centrifuge capacity (65 million SWU/year) yields 1.6 million kg of HALEU versus 11 million kg of conventional fuel. The infrastructure is the same. The throughput isn't.

Chokepoints

The fuel cycle looks linear on paper. In practice, it has three points where demand stacks up against fixed capacity. Each one matters differently depending on which nuclear story you're tracking. Importantly there is no chokepoint on uranium ore or yellowcake.

Chokepoint 1: Enrichment

The Russian state-owned company TENEX produces 46% of global enrichment capacity 9. Combined Western capacity is about 54% but geographically constrained. Centrus is the only US-based company but produces less than 1% of global enrichment (demo-scale only). The US imports roughly 20-25% of its enrichment from Russia 10, earning Rosatom ~$1 billion/year from US uranium exports.

On May 13, 2024, President Biden signed H.R. 1042, the Prohibiting Russian Uranium Imports Act 11. The law bans unirradiated low-enriched uranium from Russia effective August 11, 2024. DOE can issue waivers through January 1, 2028, but all waivers terminate on that date 12. From 2028 through 2040, no Russian LEU enters the US market.

This gives utilities roughly two years to secure alternative supply. Historically new centrifuge cascades take 8-10 years to build and license 13. Urenco's New Mexico expansion took 7 years from groundbreaking to full capacity. No Western company has announced capacity additions at the scale needed to replace Russian supply. The US-based enrichment facility Centrus has a backlog totaling $3.9 billion through 2040 14. Spot SWU prices near historic highs at ~$188/SWU 15, with limited liquidity.

Chokepoint 2: Conversion

Conversion is the forgotten middle child of the nuclear fuel cycle. Everyone talks about uranium mining and enrichment. Almost nobody talks about converting yellowcake powder into gas.

The current Western conversion capacity is about 34,500 tU/year. The facilities administering this conversion are running near capacity. Only three Western facilities: Orano (Tricastin), Cameco (Port Hope), ConverDyn (Metropolis). This was the binding constraint before enrichment tightened.

In November 2017, Honeywell placed its Metropolis Works facility, the only US conversion plant, on idle standby due to an oversupplied UF₆ market 16. At the time, spot conversion prices had collapsed to around $4-5/kgU. In February 2021, ConverDyn announced plans to restart, targeting early 2023 production 17. The restart cost approximately $150 million and required hiring 160 full-time employees 18. By late 2024, North American spot conversion prices reached a record $97/kgU which is roughly 20x the 2017 lows 19. Long-term conversion prices finished 2024 at $50/kgU, up from $34.25/kgU a year earlier 20.

You can't enrich what you can't convert. Conversion bottleneck delays cascade downstream. ConverDyn is now operating at about 7,000 tU capacity half its original 15,000 tU nameplate 21. The plant is sold out through 2028 22.

Chokepoint 3: HALEU The Fuel That Doesn't Exist

Hyperscaler SMR commitments require higher enrichment concentration. Google's Kairos investment of 500 MW requires TRISO fuel at about ~19.75% enrichment. Meta's Oklo plan for 1,200 MW requires highly enriched metallic fuel (HALEU). Meta's TerraPower investment of 2,800 MW needs metallic fuel at about ~19.5% enrichment. In total that's about ~4,500 MW of contracted capacity dependent on fuel that doesn't exist at scale.

Current global Western HALEU production is about ~900 kg/year, produced entirely by Centrus at its Piketon, Ohio demonstration cascade 23. In June 2025, Centrus completed delivery of 900 kg of HALEU to DOE under Phase II of its contract, the first significant domestic HALEU production in over 70 years 24. The DOE projects that more than 40,000 kg of HALEU will be needed by 2030, with demand reaching 50,000 kg/year by 2035 and over 500,000 kg/year by 2050 25. That is a 44x shortfall from current production to 2030 demand.

HALEU also requires 7x more SWU than conventional LEU, making it more expensive and more work to produce. The passage of H.R. 1042 unlocked $2.72 billion in funding; $2.02 billion for LEU production and $700 million specifically for HALEU 26. But the timeline to deploy that funding at scale remains unclear. Nine out of ten advanced reactor designs funded by the US government require HALEU 27.

The Implication

The hyperscaler nuclear deals split into two categories.

Microsoft, Amazon, and Meta's Vistra/Constellation contracts are buying power from existing reactors or restarts. The fuel cycle for these plants is strained but functional. Execution risk is grid connection, regulatory approval, PPA pricing. The uranium shows up.

Google's Kairos deal, Meta's Oklo and TerraPower commitments, these are different. They're buying power from reactors that need fuel that doesn't exist at commercial scale. 900 kg/year from one facility. 40,000 kg/year needed by 2030. 44x shortfall.

We've seen what happens when fuel cycle capacity disappears. In 2017, Metropolis shut down because conversion prices collapsed to $4/kgU. By 2024, spot prices hit $97/kgU, a 20x move and the plant is sold out through 2028. Conversion was the warning shot. Enrichment is next. HALEU doesn't have a warning shot because there's nothing to shut down. The commercial supply chain doesn't exist yet.

The supply chain stages map to different investment exposures:

- Mining (U₃O₈): Supply adequate. Kazakhstan dominates. Retail access via Sprott Physical Uranium Trust, Yellow Cake plc.

- Conversion (UF₆): Near capacity, 20x price move since 2017. No direct retail exposure.

- Enrichment (SWU): Russia controls 46%. Centrus is the only public Western play. Spot markets are OTC, illiquid.

- HALEU: 44x supply gap. Centrus is the only producer. Current output is DOE-owned.

Cameco gives you mining plus conversion. Centrus gives you enrichment plus HALEU optionality. Neither gives you pure SWU exposure. The further downstream you go, the more concentrated the chokepoints, and the fewer ways to express a position.

The $2.7B in DOE funding is real. The 2028 Russian ban is law. But centrifuge cascades take 8-10 years to build. The SMRs that DOE is funding need fuel that DOE's enrichment programs won't produce at scale until the 2030s. The policy supports the reactors. The policy doesn't close the fuel gap in time.

Citations

S&P Global, "Datacenter Market Monitor," Oct 2025. Data Center Dynamics

EIA, average US home consumption ~10,500 kWh/year. EIA FAQ

EIA, "US operates world's largest nuclear fleet," 2025. EIA

Goldman Sachs, "10GW+ nuclear capacity contracted," Sep 2025. Technology Magazine

Morgan Stanley/McKinsey hyperscaler capex estimates, 2025. Fusion Worldwide

IEEE ComSoc, "Hyperscaler capex >$600B in 2026," Dec 2025. IEEE

Goldman Sachs via I/O Fund, "$1.15T capex 2025-2027," Nov 2025. I/O Fund

EIA capacity factor data, nuclear at 92% in 2024. EIA

PJM queue data; Goldman Sachs grid analysis, Feb 2025. Goldman Sachs

Columbia CGEP, "Reducing Russian Involvement in Western Nuclear Power Markets," Jan 2023. Russia held ~46% of global enrichment capacity in 2018. Columbia SIPA

EIA Uranium Marketing Annual Report, 2024. Foreign-origin SWU included 20% from Russia in 2024. EIA

DOE, "Biden-Harris Administration Enacts Law Banning Importation of Russian Uranium," May 2024. DOE

Congress.gov, H.R. 1042 - Prohibiting Russian Uranium Imports Act. All waivers terminate January 1, 2028. Congress.gov

World Nuclear Association, "Uranium Enrichment." Enrichment is capital intensive with significant barriers to entry. WNA

Centrus Energy Q3 2025 Results, Nov 2025. Backlog of $3.9 billion through 2040. Centrus

Centrus Energy Q3 2025 Results, Nov 2025. "With LEU SWU prices near historic highs, there is clear, accelerating market demand for a new U.S.-owned enrichment supply." Centrus

World Nuclear News, "Idled US conversion plant preparing for 2023 restart," Feb 2021. Honeywell announced temporary suspension of UF6 production in November 2017. WNN

World Nuclear News, "US conversion plant gears up for next 40 years," Apr 2021. Restart plan targeting production in 2023. WNN

POWER Magazine, "Honeywell to Reopen Sole U.S. Uranium Conversion Plant," Feb 2021. Restart cost ~$150 million, hiring 160 employees. POWER

Cameco Q4 2024 MD&A, Feb 2025. North American spot conversion price reached record $97/kgU at end of 2024. Cameco

Cameco Q4 2024 MD&A. Long-term UF6 conversion prices finished 2024 at $50/kgU, up $15.75 from end of 2023. Cameco

Energy Intelligence, "Nuclear Fuel: Metropolis Sold Out through 2028," Nov 2023. The facility is expected to reach its targeted annual production rate of 7,000 tons of uranium as UF6. Energy Intelligence

Energy Intelligence, "Nuclear Fuel: Metropolis Sold Out through 2028," Nov 2023. Energy Intelligence

IAEA, "Fuelling the Future: Building Fuel Supply Chains for SMRs and Advanced Reactors." Piketon's HALEU cascade expected to produce 900 kg in 2024. IAEA

POWER Magazine, "Centrus Completes 900-kg HALEU Delivery to DOE," Jun 2025. First significant domestic production of HALEU. POWER

DOE, "What is High-Assay Low-Enriched Uranium (HALEU)?" DOE estimates domestic demand could reach 50 metric tons per year by 2035. DOE; Federal Register, DOE HALEU EIS, Mar 2024. DOE projects more than 40 MT needed by 2030, over 500 MT by 2050. Federal Register

Utility Dive, "Congress passes Russian uranium import ban, unlocking $2.7B," May 2024. $2.72 billion freed up including $700 million for HALEU. Utility Dive

IAEA, "Fuelling the Future." Nine out of ten advanced reactor designs funded by the US Government need HALEU. IAEA